Learn

|

Articles

|

Matilde Alves

|

27 September 2023

In the ever-evolving landscape of financial services & fintechs, staying ahead of the curve isn’t just an advantage—it’s a necessity. Banks & fintechs are rapidly adopting AI for use cases like fraud detection, AML, KYC, and customer service, using a mix of services (i.e. Open AI) and proprietary models, while navigating complex regulatory waters.

While deployment and other technical challenges prevailed over the last few years, the focus is shifting more and more towards other challenges, including explainability, transparency and AI GRC (Governance, Regulation and Compliance). This is where Deeploy steps into the picture, the European Responsible AI platform that ensures transparency and governance of AI applications.

Learn more about why and how industry leaders like Independer, Brand New Day, and Bunq chose to work with Deeploy.

As AI becomes more prevalent in banking and fintech, concerns about how these applications might utilize information and make decisions also grow, particularly in high-risk scenarios like credit scoring or fraud detection.

In line with these concerns, various nations are coming forward with guidelines and regulations to safeguard fundamental rights while still allowing for AI innovation.

Therefore, AI transparency and explainability are crucial in order for financial institutions to stay compliant with regulations, assess risk, and maintain client trust.

Both these concepts go hand in hand, as transparency is only possible when the explainability of AI model decisions is in place. Which general trends are represented by the model? Which feature contributed most to the prediction/decision?

Having this transparency in place helps avoid biases, validate and debug models, and supports continuous improvement through feedback loops.

In the highly regulated and competitive financial sector, transparent AI not only ensures compliance but also fosters trust, reduces risks, and enhances decision-making, making it indispensable for success.

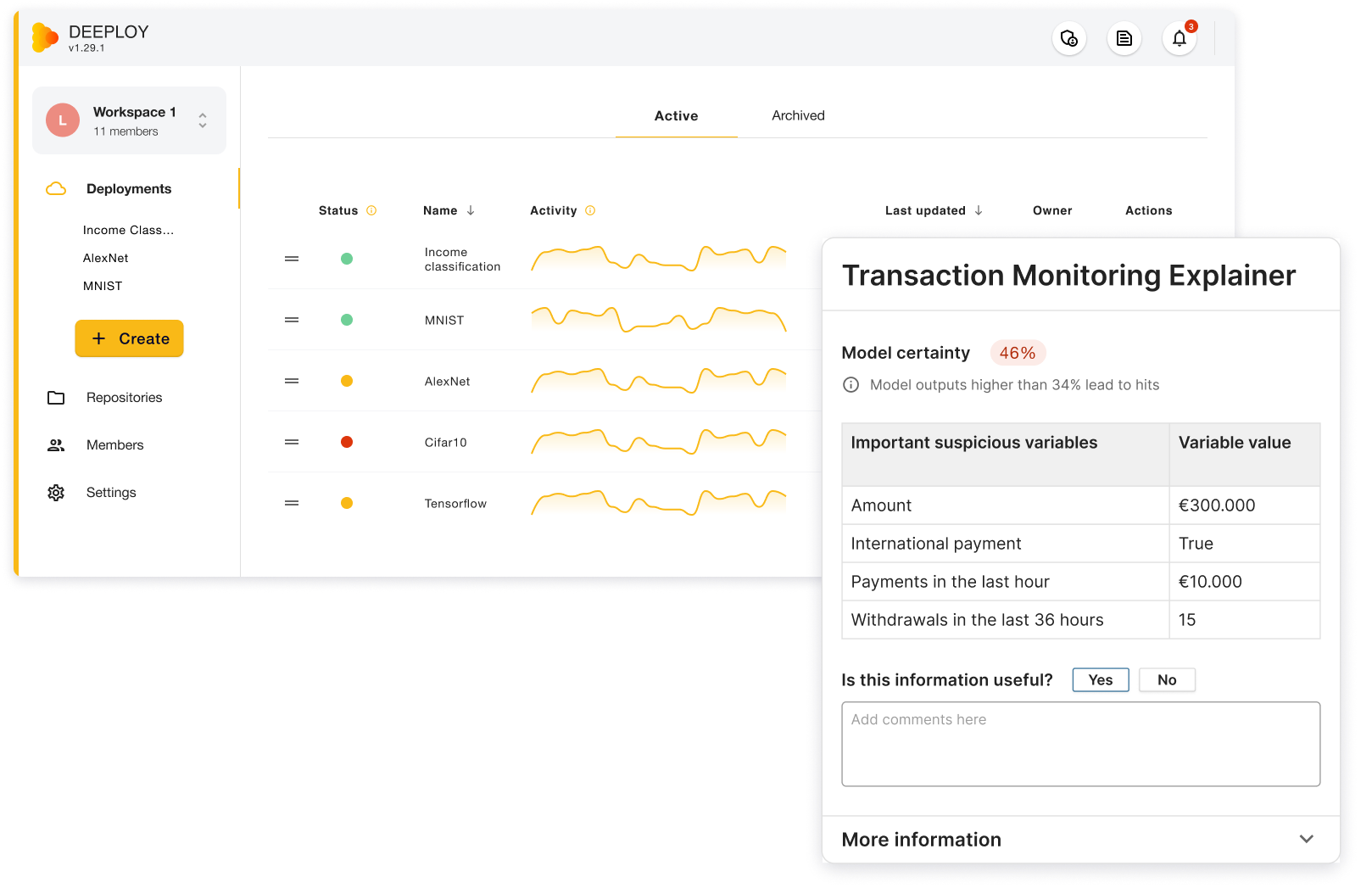

Deeploy covers all these transparency & explainability requirements, supporting the main explainability frameworks, like SHAP, Anchors, PDP, and MACE, as well as a large set of tailored explainability methods for specific use cases such as transaction monitoring. Furthermore, Deeploy allows for the collection of feedback from stakeholders and end users of the AI models, allowing that information to be used in a feedback loop system for model improvement.

Altogether, Deeploy helps financial institutions understand how AI models make decisions and identify potential biases. This transparency is crucial in maintaining trust between humans and machines, especially in high-stakes financial transactions.

AI-GRC (Governance, Regulation, and Compliance) is crucial for financials, given the increasing regulatory pressure. By ensuring adherence to complex regulations, financial institutions reduce errors and mitigate the risk of costly fines.

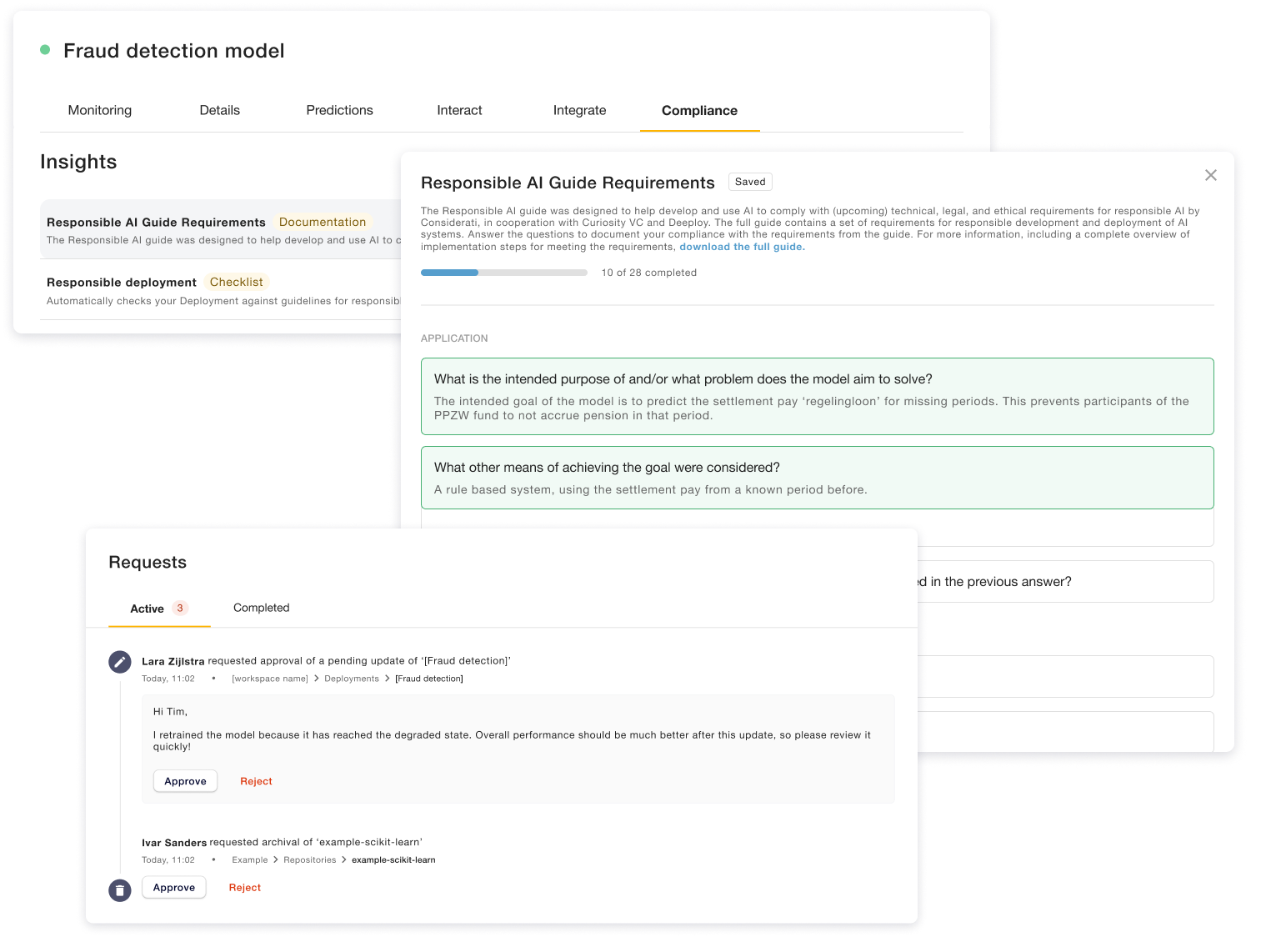

Deeploy combines the power of explainability & monitoring with robust regulatory features such as automated checklists and compliance assessments on model level and an integrated model registry with automated alerts built in.

In this way, Deeploy helps financial institutions hold themselves accountable for their use of AI. By providing insights into how AI models make decisions, it enables financial institutions to identify and address any potential issues that may impact their decision-making processes. And, by integrating checklists and assessments into the platform, Deeploy ensures organizations keep track of compliance with regulations related to AI as well as internal organizational policies.

Deeploy secures the safe use of data and AI with its private cloud model, ensuring sensitive information stays within the organization’s protective embrace.

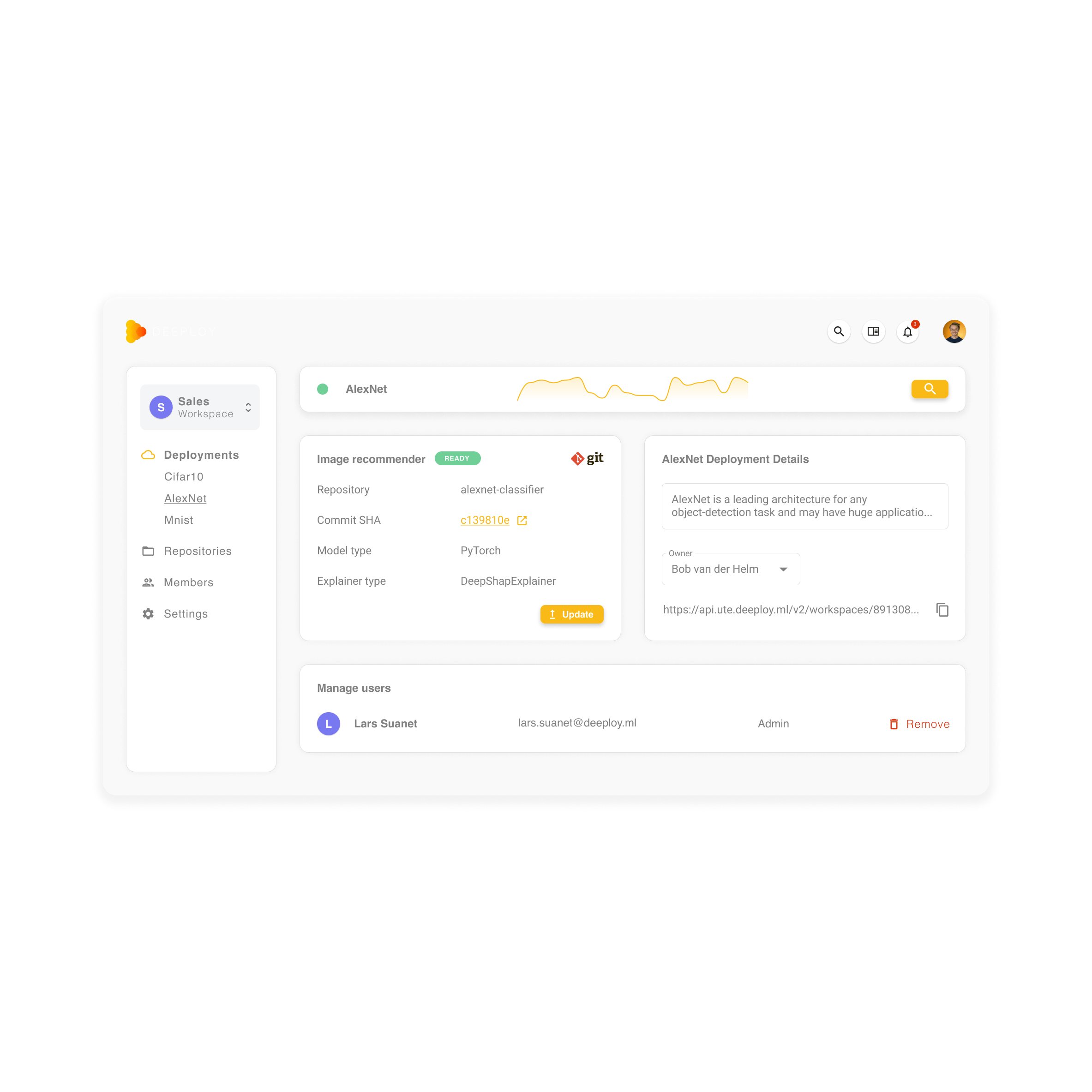

Furthermore, Deeploy smoothly integrates into any organization’s MLOps stack, complementing the use of platforms such as Azure ML, Sagemaker, and MLFlow. In this manner, Deeploy allows organizations to seamlessly transition their models into production and provides an environment where organizations can keep control of every model running.

Deeploy’s user-friendly interface helps teams effortlessly incorporate AI models into their existing systems, slashing costs and time by automating complex deployment tasks. Say goodbye to expensive consultants and specialists. And when you need it, Deeploy goes the extra mile, offering implementation, training, and comprehensive documentation to supercharge your success.