DDFinance: an insurtech for the African market

Deeploy use case

Responsible claim handling

Sometimes you just happen to find the perfect match. For us, this was definitely the case with DataDrivenFinance (DDFinance), a Norwegian-based insurance tech with a beautiful mission: contributing to a better insured world by marking sure every low-income family has access to proper healthcare. Starting in Kenya, DDFinance connects traditional insurers with local communities to provide health and life insurances.

Insurance in Africa

In most African countries, millions are working in the informal economy, making it hard to get access to healthcare and health insurance. Without insurance, people run the risk of losing all their hard work and might end up in severe poverty. Take Kenya: over 80% of the population does not have access to any kind of health insurance, according to the World Health Organisation. The insurance industry has not yet found ways to access this market, due to knowledge of the market, training, trust and relatively high costs to operate in these markets.

DDFinance

DDFinance invented a truly revolutionising method to access the Kenyan market by insuring collectives (families, tribes, communities), rather than individuals. By doing so, DDFinance builds on digitising informal trust and reputation within groups, while keeping operational costs relatively low, bridging the gap between insurers and local communities. Currently, DDFinance supports over 20.000 Kenyan families with their first health insurance, with the ambition to scale to millions in the upcoming years.

In order to scale, it’s pivotal to DDFinance to partly automate claim handling, meaning that incoming claims from customers can be validated by data, rather than people. They started this journey several years ago, built their first models, but were not yet able to deploy and use these models in their daily business without losing transparency, trust, accountability and explainability of their decision making.

Use case “Responsible Claim Handling”

- Ambition: partly automate claim handling, without losing the human touch, avoiding the risk of unjustified decisions.

- Situation: currently claim handling is performed by the local ops team, reaching its limits. DDF is looking for ways to make its organization more scalable, reducing costs, without losing control.

- Models: the models at DFF aim to predict the risk in terms of expected loss, based on claim and collective data.

Challenges

- Transparent & Trustworthy: always be able to explain why claims are approved (to underwriters) or declined (to customers).

- Accountable: make absolutely clear who is responsible in which part of the process, by giving people the tools to upgrade & overrule.

- Doing good: DDF was started to make healthcare available to African societies. Doing good is in their DNA, and should be reflected.

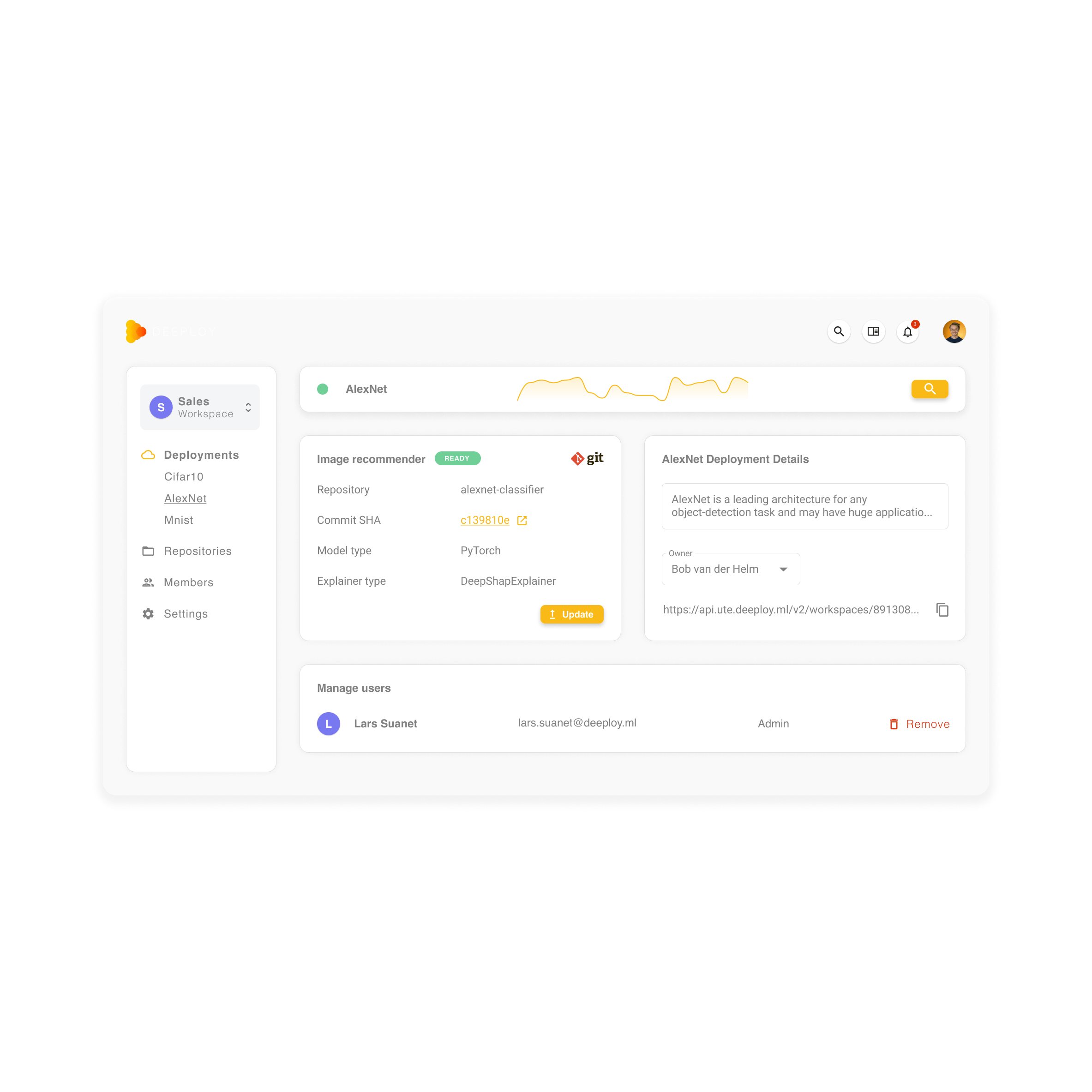

Approach & realized benefits through Deeploy

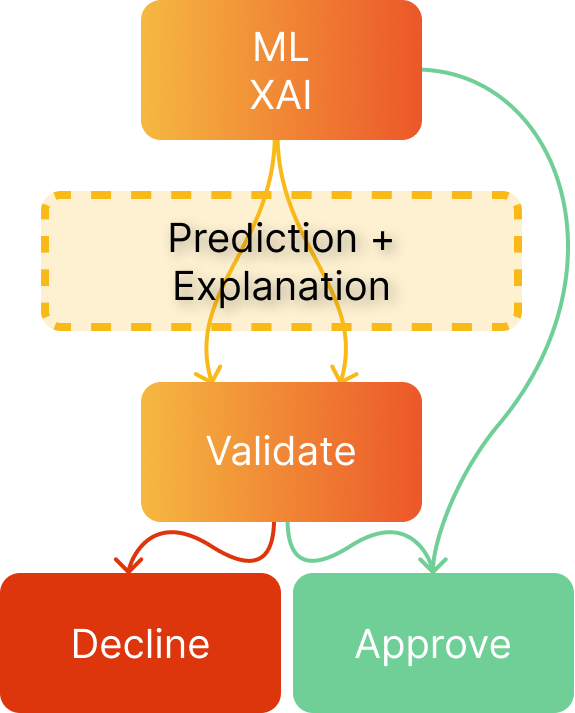

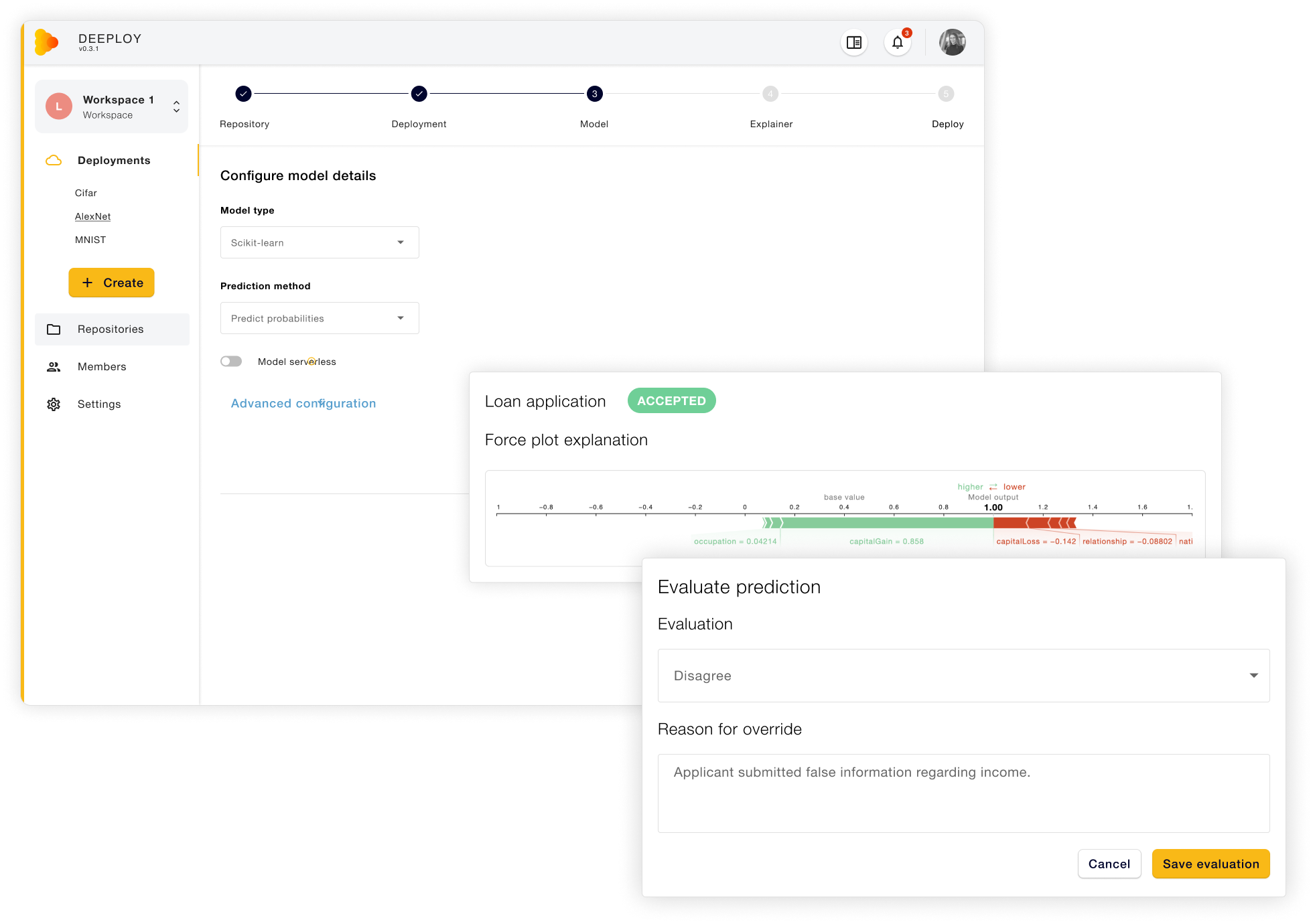

Deeploy helped DDFinance by designing and implementing their first ML models to support their claim handling process. Deeploy forms the central place to deploy and update models & explainers, which are integrated in the software of DDFinance. In this way, the operational team gets informed about the risk of each claim (high, medium or low) and decides on the appropriate next actions, which ranges from approval and pay out, further investigation or in some cases refusal of payments.

Implemented features

- Easily deploy & update models

- Explain how decisions are made

- Overrule or approve decisions

- Audit trail to reproduce results

By using Deeploy, DDFinance makes sure their claim handling process can be supported by ML models, without losing transparency, explainability to customers or traceability of the decisions they make.

Contact us to find out more about Deeploy, and how we could help you out.